Making successful stewardship a reality

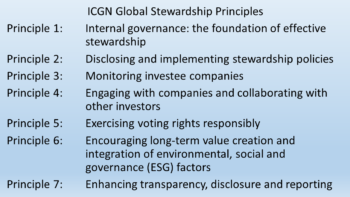

One of our core policy priorities at ICGN is encouraging responsible institutional investment practices, particularly to ensure that investors are exercising their fiduciary duty towards their clients diligently and with a view to supporting long-term value creation by companies. A key ICGN policy initiative that stems from this policy priority is the launching of ICGN’s Global Stewardship Principles, which were approved at the ICGN annual meetings in San Francisco in June 2016.

These Principles provide guidance on both internal governance for investors and on external stewardship practices between investors and companies. The initiative to develop these Principles builds on ICGN’s existing policy framework, and is intended to serve as a global point of reference for both investors and companies on what stewardship entails and how to implement it in practical terms. We hope that these Principles will serve as a point of reference to guide jurisdictions seeking to establish or update their own stewardship codes by providing an overarching global model of stewardship that can be adapted to the individual situations of countries or regions. We also believe that this has broader systemic implications in terms of promoting healthy capital markets and economic development.

These Principles provide guidance on both internal governance for investors and on external stewardship practices between investors and companies. The initiative to develop these Principles builds on ICGN’s existing policy framework, and is intended to serve as a global point of reference for both investors and companies on what stewardship entails and how to implement it in practical terms. We hope that these Principles will serve as a point of reference to guide jurisdictions seeking to establish or update their own stewardship codes by providing an overarching global model of stewardship that can be adapted to the individual situations of countries or regions. We also believe that this has broader systemic implications in terms of promoting healthy capital markets and economic development.

Investor Governance is the key starting point

As I was charged with researching stewardship codes around the world and the main drafting of the ICGN Global Stewardship Principles, I had the benefit of receiving considerable input from the ICGN board, policy committees, and membership – as well from individual members of the Global Network of Investor Associations. This process helped not only to sharpen our own conclusions and build consensus about stewardship best practice; it also gave us confidence that there is broad support in the investment community for ICGN to identify principles and practices of investor stewardship that are relevant in a global context. While this is positive, at the same time we are aware that the evidence base has still to build about the effectiveness of stewardship; it is still early days.

But even without a huge basis of evidence, we need to make this work. In particular for jurisdictions with “comply or explain” governance systems to be effective, it is primarily the role of institutional investors to monitor companies and use ownership rights to challenge companies when necessary. Without the active monitoring of explanations by investors, a “comply or explain” system would lack an ultimate means of enforcement or influence—or teeth. A stewardship code therefore plays a critical role in providing a market-based mechanism for investors to hold companies to account for their corporate governance practices.

This preparation of the Global Stewardship Principles exposed us to some of the challenges facing the investment management sector (both asset owners and asset managers) with regard to the implementation of stewardship in practice. This led to our making the institutional investor’s own internal governance as priority number one. If there is weak top down endorsement or resourcing of stewardship in institutional investors, then stewardship will lack a sufficient foundation to be effective. So it may not always be easy, but the consequences of insufficient stewardship are likely to be poor company governance, increased regulation—or both.

Integrated Reporting, integrated thinking and stewardship

Like many other national or regional stewardship codes, the ICGN Global Stewardship Principles place emphasis on stewardship activities relating to policy development, monitoring, engaging and voting. However a distinctive feature of the ICGN Principles is the emphasis on long-term value creation and the integration of ESG factors into stewardship activities. We encourage companies to publish integrated reports, and believe this will continue to build in the future. But linked to this we also encourage integrated thinking and Integrated Reporting to link environmental, social and governance (ESG) and other qualitative factors more clearly with company strategy and operations– and ultimately long-term value creation. Integrated thinking, like stewardship, continues to build in awareness. But a steep growth curve still exists.

Notwithstanding the challenges to achieving good stewardship, we believe that it is both achievable and worth achieving. But it is also important to build awareness of the challenges to such stewardship. Internal governance, and the alignment of investor business models with the practice of stewardship, ultimately provide the foundation for making effective stewardship a reality.