Global shifts

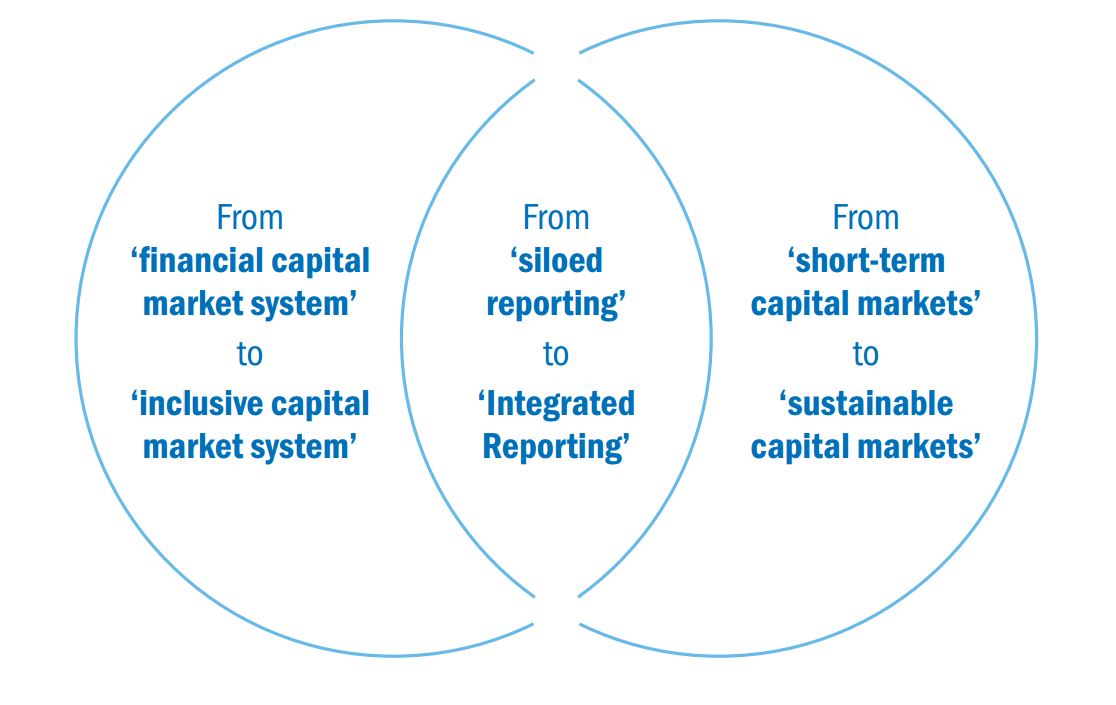

Through engaging with influential decision-makers worldwide, we are calling for three gear shifts in terms of global economic governance.

The first is a shift from financial capital market system to inclusive capital market system. We encourage governments, central banks, stock exchanges and standard setters to recognise the interconnection between finance, people, planet and knowledge, and embed systems of governance and reporting that enable integrated thinking and reporting to become mainstream.

The second is a shift from short-term capital markets to sustainable capital markets. To end the incentive systems that perpetuate short-term thinking and decision-making, we encourage the introduction of reporting codes focused on strategy, resource allocation and value creation over the short, medium and long-term.

Finally, a shift from silo reporting to integrated reporting. We are leading the drive to bring about a corporate reporting system that is both principles-based and cohesive, and urging policymakers to remove all regulatory barriers to integrated reporting adoption and introduce policies that are consistent with its principles of connectivity of information, multiple capitals and future orientation.