Getting Started with Integrated Reporting: Mahindra Group

Integrated Reporting is in the rise in India. In this case study Investor Relations and Sustainability leaders at Mahindra Group spoke to Vrushali Gaud, <IR> Associate, IIRC about how and why they’ve evolved their approach to Integrated Reporting.

Mahindra has always striven to be at the forefront of sustainable development and the adoption of progressive practices, which is reflected in its business segments, products, processes and reporting initiatives. It is reflected in the philosophy of Mahindra ‘Rise’ which is a call to action that pushes group businesses to innovate, be purposeful, grow profitably but also drive positive change.

In line with this philosophy, the reporting process evolved to incorporate changes in the Indian regulatory requirements such as corporate social responsibility, business responsibility reporting, the companies act and in global practices such as UNGC, GRI and carbon pricing. The company website was redesigned to present a digital view of how the company was driving this change. The commitment to sustainable development issues is reflected in the well instituted sustainability framework and the annual ESG focused investor meeting convened by Mahindra, the first of its kind in India.

Integrated thinking has always been a core part of the DNA at Mahindra and so the basic elements of creating an integrated report were already in place.

“While we might be an early adopter of Integrated Reporting in India, for us at Mahindra it is but a natural progression in our journey to empower our stakeholders with detailed knowledge about the organisation, its holistic performance, its strategy and the preparedness for the future.” Mr. V.S. Parthasarathy Group, CFO & CIO,

<IR> Journey

Mahindra’s leadership team was involved early on in supporting <IR> activities in India through the CII <IR> Lab. Top leadership awareness was the driving force towards getting finance and sustainability leaders engaged in understanding the framework. But the biggest push came from the perceived benefits of using an Integrated Reporting approach for investor communication.

In mid-2016 a cross functional team was tasked with understanding the gaps in current reporting practices and creating a roadmap towards developing an integrated report. After completing a gap assessment of current reporting practices vis-a-vis the <IR> framework, that a decision was taken to convert the annual sustainability report to an integrated report. The 3P sustainability framework was mapped to incorporate the six capital approach and connect with business processes and strategy.

The February 2017 SEBI circular recommending the <IR> framework was another trigger to pilot an integrated report for internal purposes with the intent of launching it during the 2018 reporting cycle. The pilot report was presented to the board in April 2017. Impressed with the direction and content of the pilot report, the timeline was advanced. Mahindra’s integrated report was launched by chairman Anand Mahindra at the AGM in August 2017.

Team Structure

“Our approach to sustainability stems from an integrated and long term view of the business. The integrated report helps communicate how our business strategy of purposeful growth is closely linked with the sustainability framework.” Mr. Anirban Ghosh, Chief Sustainability Officer, Mahindra Group.

The sustainability and investor relations team jointly led the effort towards creating the report. Sustainability team provided the non-financial data. The finance and investor relations team led efforts on the financial data and business context. Corporate communications team was involved in ensuring that the report was in line with branding guidelines and consistency with all other reports. The senior leadership team including Group CFO and Group President overseeing sustainability efforts were closely mentoring the teams in completing the report.

Benefits and Investor feedback

“The <IR> Framework presented an opportunity to tell the company’s story to investors in a holistic manner but also allowed for flexibility in formulating that communication.” Mr. Sriram Ramachandran, Head Investor Relations, Mahindra Group

The company has seen internal and external benefits from adopting <IR>. The cross functional approach led to greater collaboration between finance, sustainability and corporate communications teams. Also visible were improvements in alignment of sustainability with business performance, articulation of company’s business activities and clarity in investor communications. But the most prominent feedback has been from investors, who greatly appreciate the inclusion of more relevant and holistic information in the report.

Looking ahead

The company is looking to gain insights and feedback on how to further evolve the reporting suite to meet the target of having one integrated report to effectively connect and communicate with investors and stakeholders.

Excerpts from the 2016 Mahindra annual integrated report

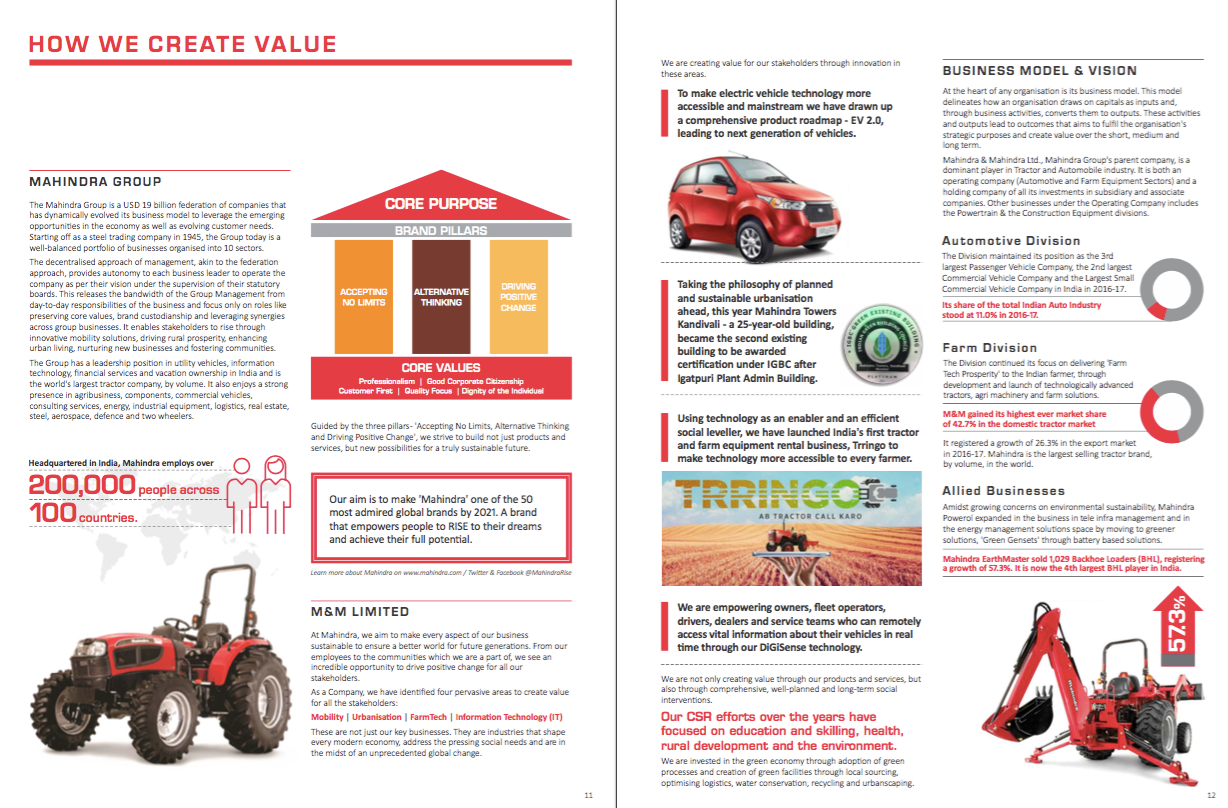

Value creation model:

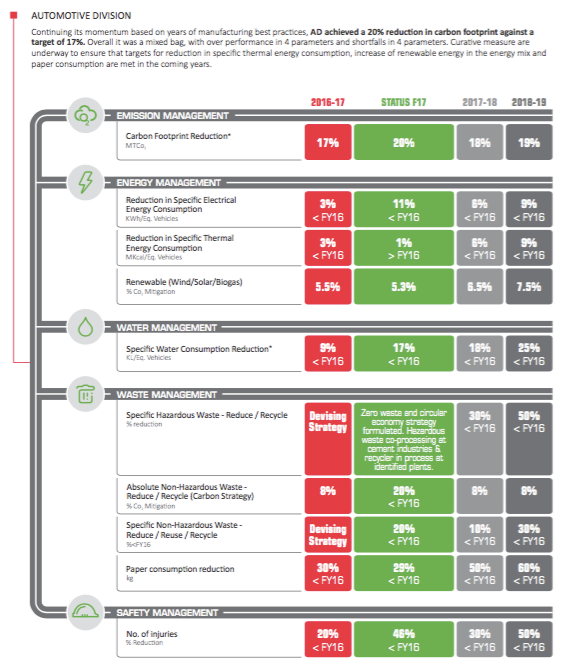

KPIs past, current and future:

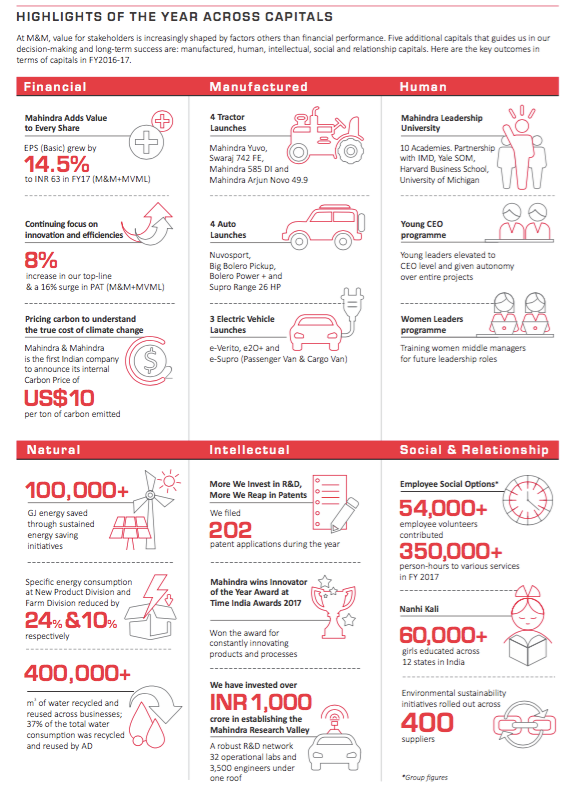

Multi-capitals: