Integrated reporting in India: 2019

Over the past few years, India has seen remarkable progress in corporate reporting and disclosures. Investor requirements, societal expectations and introduction of regulations have all contributed towards transparency and broadening of corporate disclosures beyond traditional financial parameters. One key driver was the circular issued in 2017 by the Securities Exchange Body of India (SEBI) that recommended Top 500 companies should consider the use of the Integrated Reporting <IR> Framework for annual reporting.

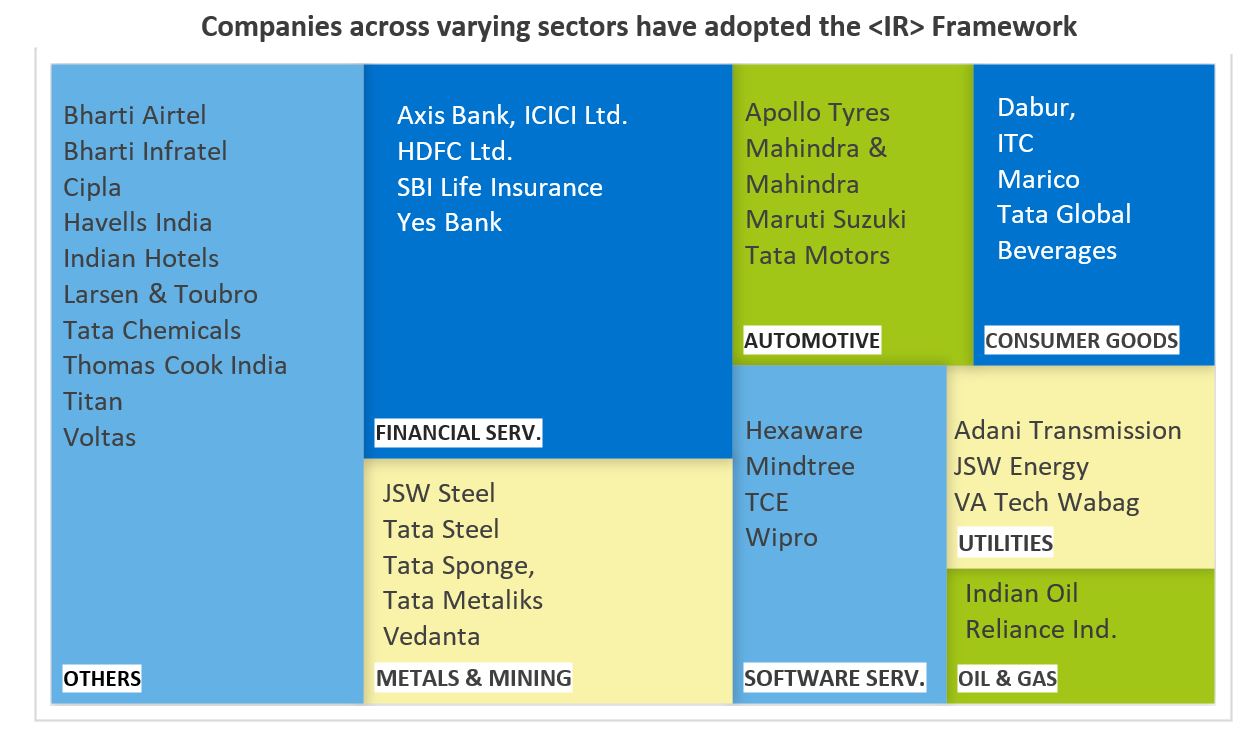

Consequently, there has been a surge in the adoption the <IR> Framework and its multi-capital reporting approach. In 2017 there were a few pioneering Indian companies such as Tata Steel, Mahindra and Mahindra, Wipro, Yes Bank and Reliance Industries that begun their integrated reporting journey. Subsequently 2018 saw a significant increase with more than 30 companies having adopted the <IR> Framework. In 2019 already more than 45 companies are expected to adopt the Framework to link their purpose and outcomes across capitals through their strategies and business models to deliver a report that articulates their approach to value creation. A majority of the companies have used the <IR> Framework to refine and connect aspects across their annual report.

The scale of adoption can be reflected upon through the NIFTY 50, which is National Stock Exchange of India’s diversified index of top 50 stocks across 12 sectors and has a market cap of ~ 2 Trillion USD. More than 40% of NIFTY companies, total market cap of 350 Billion USD, have embraced the <IR> Framework in their annual filings.

Preliminary observations provide evidence of positive benefits to both the companies adopting integrated reporting and their stakeholders, specifically the investor community. Some of these include

- Boards are taking ownership of integrated reports and taking a lead in articulating the value creation process. There is more tie in with corporate governance, risk reporting and strategy.

- Across sectors companies are considering and reporting on the use and affect across various capitals through quantitative metrics and narratives.

- Annual reports are better connected and show how strategies and business model are creating value. Because of the multi-capitals view companies are reporting outcomes for themselves and for their stakeholders, especially on natural and social capitals.

- Effective use of infographics and web technology has improved user engagement and quality of presentation

Both at a national and global level, efforts to streamline reporting frameworks is required to alleviate the reporting burden on companies. Effective use of materiality principles and leveraging web-technology can further enhance the relevance and readability of the reports.

For emerging fast growing nations like India the challenge will be to aggressively grow the economy, invest in infrastructure, skill and education to meet the aspirations of a burgeoning middle class and millennial population. But at the same time understand and influence the trade-offs – depleting forest cover, water scarcity, poor air quality, climate vulnerabilities and income inequality. Therefore this momentum towards better reporting should continue to progress with more companies embracing the framework and the integrated thinking approach that would enable an outcome based holistic view of how they create value for themselves and the extended society.