WICI and IIRC Formalise Agreement to Work Towards <IR>

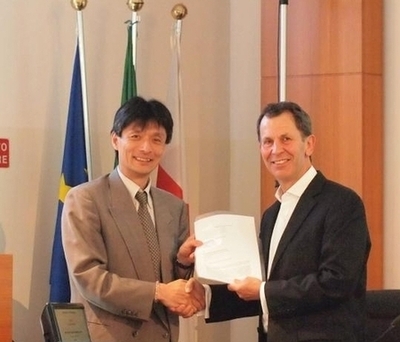

(Italy, London, Tokyo June 12, 2013) – The International Integrated Reporting Council (IIRC) and the World Intellectual Capital Initiative (WICI) have signed a Memorandum of Understanding (MoU) to promote cooperation, ensuring that “intellectual capital” is reflected as a crucial and essential source of an organisation’s value creation within Integrated Reporting <IR>.

(Italy, London, Tokyo June 12, 2013) – The International Integrated Reporting Council (IIRC) and the World Intellectual Capital Initiative (WICI) have signed a Memorandum of Understanding (MoU) to promote cooperation, ensuring that “intellectual capital” is reflected as a crucial and essential source of an organisation’s value creation within Integrated Reporting <IR>.

<IR> is the language of resilient business. It is a process that results in communication by an organisation, most visibly a periodic integrated report, about value creation over time. Intellectual capital is organisational, knowledge-based intangibles, including intellectual property, tacit knowledge, systems, procedures, and intangibles associated with the brand and reputation. In today’s knowledge-based economy, intellectual capital is becoming a major part of that value creation. WICI is globally recognised for the work it does in the area of intellectual capital, improving the reporting of intellectual assets and capital and key performance indicators that are of interest to providers of financial capital and other stakeholders.

Commenting on the MoU, Paul Druckman, IIRC’s CEO says, “Communicating how an organisation develops and exploits intellectual capital and deploys innovation is key to understanding value creation. We look forward to deepening our collaboration with WICI in this important area.

“Standard & Poor’s, a US ratings firm, published research which demonstrates that in the 1970′s 80% of a company’s market value could be traced through to its financial statements. Today, only around 20% of a company’s market value can be accounted for by its financial and physical assets. Corporate reporting needs to evolve in order to reflect this change – <IR> provides the framework to do so, and our collaboration with WICI gives the whole initiative further energy.”

Takayuki Sumita, Chairman of WICI Global, said “The essence of a business is to create value over the long, as well as the short and medium term, by utilising its strengths supported by the range of capitals available to it. Therefore, the most important part of corporate reporting is for a business to tell its individual value creation story, providing evidence of how the organisation has created value in the past and its plans for creating value in the future.

“The collaboration between WICI and IIRC will help further the evolution of corporate reporting. Creating a new corporate reporting language will enable organisations to communicate their own value creation story more effectively with investors which will facilitate better decision making and, in turn, contribute to a more sustainable global economy.”

NOTES TO EDITORS

-

- The International Integrated Reporting Council (IIRC) is a global coalition of regulators, investors, companies, standard setters, the accounting profession and NGOs. Together, this coalition shares the view that corporate reporting needs to evolve to provide a concise communication about how an organisation’s strategy, governance, performance and prospects, in the context of its external environment, lead to the creation of value over the short, medium and long term.

- WICI’s mission is to ①Conduct awareness-building activities for many organisations and investors to understand and implement the concept of “Intellectual Capital/Assets-based Management” in a positive and constructive way;②Provide a regularly updated reporting and disclosure framework as a tool for an improved communication between any organisations and their stakeholders about “IAbM”; ③Participate actively in the discussion about other internationally recognised reporting and disclosure frameworks, and provide WICI inputs into the emerging globally accepted framework in this field;④Elaborate a reporting framework that since the beginning it is also expressed in, and integrated with, a digital standardised technological language, such as XBRL;⑤Identify and promote industry-specific KPIs (Key Performance Indicators) so to favour the organisations to realise the substance of the “IAbM”, as well as to disseminate and build on the idea that these industry-specific KPIs are NOT a set of indicators that organisations must disclose, but rather that the organisations can freely select to fit with the substance and features of their own management and value creation processes. For more information visit:https://www.wici-global.com.

- A link to the Consultation Draft of the International Integrated Reporting Framework can be found here.

- A list of businesses and investors involved in the IIRC’s work can be foundhere.